Liberal AJC still hawking Kasey Carpenter HB 120 scam

Image: DIS/sourcers as noted.

From ImmigrationPoliticsGA.co

Liberal AJC still hawking fake news on HB 120 but omits “Opportunity Tuition…”

March 13, 2021Liberal AJC still hawking Kasey Carpenter HB 120 scam Image: DIS/sourcers as noted. From ImmigrationPoliticsGA.co Liberal AJC still hawking fake news on HB 120 but omits “Opportunity Tuition…”

February 20, 2021Feb 19, 2021 — HB 120 hearing, Sponsor Rep Kasey Carpenter introduces his instate tuition for illegal aliens bill TRANSCRIPT AND VIDEO HB 120 bill presentation, House Higher Education Committee, Room 341, GA Capitol. Photo: DIS

The original bill was amended with a committee substitute and presented. I was told there was no sub-committee hearing. While I began asking at 8:15 AM, the Chairman and his staff refused to give me a copy of the committee sub. I was finally able to obtain one about (somewhere around 12:15-ish, during a hearing break) 15 minutes before I was called to testify only because I asked someone else to request a copy from staff. Even after that person was handed a copy, I was told I couldn’t have one because “we just gave out our last copy…” There is more to this story. Rep Kasey Carpenter was permitted to present his bill to the committee from his parked car somewhere between Georgia and Oklahoma. I thought I heard him say he was there for ‘flowers’ for his restaurant – but later realize he said “flour.” ________________ Transcript from audio of House livestream video by Rev.com Entire hearing on video here. As of tonight, the latest version of the bill is not yet online at the general assembly website. _______

Chairman Chuck Martin HB120 by substitute. Um, LC490393S. Rep Kasey Carpenter Thank you Chairman and committee. Uh… you ready? Chairman Chuck Martin Hang on, you’re not recogni- hang on! Carpenter Wo! When I’m ready to go Daddy I’m ready to go! (silence) Chairman All right. Just le- just let me settle every, everybody uh in. That was the 30 second warning. Okay we have HB120 LC490393S. Representative Carpenter. Carpenter Thank you Chairman. I wanna start off by thanking the committee by putting up with me while I’m halfway across the uh, the country, headed over with some uh, flour for my restaurant. Um, you know, I, I also wanna address this bill. This is not a bill about immigration, this is not a policy issue at the state level that we can address so, if there are some concerns from the members about immigration policy I would suggest that uh, contacting their uh US representatives and their senators on those matters. For this bill is about allowing Georgia taxpayers to pay a taxpayer rate at certain colleges and universities in the state [crosstalk 00:01:13]. So I’m gonna uh, I’m gonna go through this sub real quick and then of course uh, go through um, the policy piece of it and then the personal piece of it. Are, are you guys hearing me okay? Chairman Carry on. Carpenter Thank you. All right, so what this bill does, is it, it, it basically allows DACA students that are in Georgia, they graduated from a Georgia high school, to attend certain colleges and universities in the, in the college system, at an in-state tuition rate. There are some limitations that are outlaw- outlined in the bill. And the first piece is the graduation diploma or [GED 00:01:51] piece. The second piece is they have to have been in the state of Georgia since 2013. The reason for this is this bill does not… present a welcome mat to the State of Georgia for DACA recipients all over the United States to come to Georgia so they can get in-state tuition rates. We wanted to make sure that everybody understood this bill is about the 20,640 DACA recipients that are currently in the State of Georgia. There’s also a cap on it. It caps it at the age of 30. Uh, the reason for that is one budgetary; I think, uh, 76% of DACA recipients fall under that 30, um, 30 age range. So there’s the budgetary concern but also, the idea that individuals that are over 30 typically do not try to pursue higher education opportunities. There is also a piece in there that does not allow them to attend research universities within the state. So currently, the current research universities are Georgia, Georgia State, Georgia Tech and Augusta (?) University. The initial reason for this was budgetary because we fund those schools at much, much higher rate. Uh, $11,000 a student versus roughly $5,000 a student at all the other colleges, state colleges and universities in the system. So it was a budgetary piece, but it also is a piece that uh, you know, there’s a conversation about are these individuals gonna be taking other Georgian seats at colleges. And it is our desire that that not be the case of this bill. This bill would simply allow certain colleges and universities to have capacity to… to offer that capacity to Georgia taxpayers at a taxpayer rate. And the conversation can be had. We allow individuals from other states, border state waivers all around the State of Georgia, from four or five different states, to pay these in-state tuition rates because there is capacity. And we know that the in-state rate that they’re, they’re charging, obviously has to be less, I mean more than the variable rate of educating that kid. So um, there’s been plenty of analogies on this matter, but basically if I’ve got a empty seat at, in a college classroom, it costs me $4,000 to educate the kid and um, they’re paying five. So there’s an added bonus there. And in, in the financial world we would call that throughput per constraint. So we’re having more throughput by having kids in that chair than just not. And so this would not, at the end of the day, retract from these colleges or universities but make them more vibrant. Um, we have 21 states in the nation that have this bill already, or something like it, including republican states of Texas, Oklahoma, Florida and Kansas. I actually see this as an uh seven year payback period for the State of Georgia, which I think is a great return on investment. Currently DACA recipients pay upwards of 61 million dollars in state and local taxes. With a college education, we know that high- they are higher earners, and, and when doing that that would probably bring another 30 million dollars worth of revenue to the state coffers on a annual basis. Of course there is a fiscal note on this bill. There’s a lot of confusions about that fiscal note. Uh, the one piece I think’s a good piece is the uh, is there’s a lot of unknowns, there’s some uncertainty. But the one piece that was good was the, uh, current DACA kids, there’s about 742 kids that are already attending universities in the state, so there would be, you know, a revenue loss there of about 4.5 million dollars. And I actually doing some extrapolation figured… we would probably see an increase of 9,000 kids into the system, uh, statewide. If you take the average, uh, take that 76% that are under 30 and then take the average number of kids that uh, typically attend universities and colleges out after high school, so I’m assuming roughly about 9,000 kids at $5,000 a pop. So we’re talking 45 million dollars. Plus the four million dollars loss of revenue current students are paying. So you’re talking about a 50 million dollar deal that would add 20 million dollars in reoccurring revenue. So um, figure four years at college, 200 million dollars, figure 20 uh, 20 to 30 million dollars, uh, in increased revenue for the state, so we’re looking at about a seven year payback which is 12 to 15 per cent, which I think’s fantastic. So um, I’ll be glad to answer any questions on this bill ’cause I’m sure there’s a lot of uh questions. And I would like to thank, I know that um, DA King is there to speak today and I would like to thank him. I’ve received a lot of emails about this bill and there’s been some concern that it wasn’t fine-tuned enough for the DACA recipients, so we made sure to insert that language for this bill. Because that’s never been our intent, was to open this up and open the floodgates of uh, uh, on this issue. It’s literally to take care of the Georgians that uh, that, that we’ve been educating for the whole time. Chairman Thank, thank you very much Representative Carpenter. I, I see no questions at this time so we’re gonna um, go down to uh, um… Oh wa- I do have a question actually virtually um, [inaudible 00:07:09] Kausche. Thank you Mr Chairman. And I just wanna uh, tell my good friend KC Carpenter thank you so much for bringing this very important bill. My question for you is which I believe uh, we talked about before and we had a similar bill, put a similar bill last session, which um, which then we couldn’t work on any more because of Covid. Uh, this is a very important bill, and isn’t it true that it will address some, or could address some of the workforce issues we’ve seen here in Georgia. I remember clearly that the uh um, state economist uh, in his presentation during the appropriations meeting said that, Georgia will need more workers. And isn’t it also true that with the Docker students, we have- would have a highly motivated workforce that actually intends to stay in Georgia. So that the return on investment we get, we get out of the students would be uh, very significant for the state, and we could close some of our workforce gaps. Thank you. Carpenter Yeah, I don’t think there’s any question about this. This a huge workforce development issue, especially in Whitfield County. Um, we have upwards of 6,000 individuals um, Docker individuals, so uh, I don’t know if you’ve ever seen the headlines but they also say that uh, Whitfield County has the lowest college, uh, rates in the nation. Uh, so they cost, I guess the best way to describe it’s we’re the dumbest county in the United States as far as college. Uh, I wouldn’t say that but you know, the numbers, the numbers do point to that as far as individuals with a bachelors degree. So this would be an immediate impact especially on my community, with educating these folks because at the end of the day employers need educated individuals, and we’ve got a pocket of individuals here that, that want to be in Georgia. The federal government’s saying they can be in Georgia, so let’s educate them so they can be higher earner and pay higher taxes. Um, to me that’s really republican. So um, but I’m glad you’re agreeing with me on it. Rep, representative Holland. Thank you Mr Chairman. Uh, thank you, uh, Representative for bringing this bill. As somebody who uh, works in the business community I think this is a fantastic opportunity to retain some of our best and brightest in the State of Georgia and, and retain them as great talent for future jobs. Um, I did have a question, in my first glance at the bill I saw that, there is an age limit as to how, as to when people can take advantage of um, the in-state tuition. I, I come from a family of people where not everyone took a linear course through college and some folks got their degrees, um, beyond the age of 22, 23 years old. And so I’m just curious to what the reason, whether that was a fiscal consideration or something else to, to limit the ages of those who could take advantage. Carpenter Yeah, I, I think a lot of it was fiscal. We heard a lot, you know, you heard Stacey, Representative Evans today talk about hOPE, that it shuts it down at 28. So we, we looked at that number and said, let’s give ’em two more years because of extenuating circumstances. But I think studies’ll show that after the age of 30, most individuals, you got kids, it gets harder and harder so, you know, why not go ahead and eliminate that subset of folks and keep those budgetary constraints in. Representative Park. Thank you Mr Chairman. Thank you Representative Carpenter. Um, I’m I, I hope you are uh, being safe while you’re out there. Um, so, given the economic benefits that this would have um uh, particularly the, the good return on investment uh, for, for Georgia taxpayers, uh, could you explain or, or do you have any concerns whether or not that return on investment would, would remain if we removed, uh the requirement um, that excludes University System of Georgia’s, uh, research universities. Um, and would you also be able to share why there’s the additional requirement of prohibiting, um, otherwise qualified students, Georgia taxpayers, um who may fall into the category of non-immigrant alien in the meaning of Aid USC section 1101. Carpenter Yeah, thank you very much. So uh, the first piece is those uh currently [crosstalk 00:11:17]… Chairman Hello, hang on. Hang on. We’re, we’re gonna, we’re gonna, um I’m gonna help you with the first portion of that. Um th- the reason the university system… um, one of the reasons the university system is in there and, and um, I will uh sound this out on, on behalf of uh Representative Carpenter, he and I have spoken before is, there’s constitutional issues in Georgia about public benefits, uh relative to uh, w- we use the term here lawful, people that are lawfully present, uh Representative Park. So at, at, at this point the university already has a policy that does not allow, uh, individuals that are not law, that do not have a lawful presence. It, it mends to certain, um, units of the university system. So as a matter of fact… there’s not access by university rule for constitutional reasons that would, would not allow those individuals to be admitted to the school, so going to uh, uh tuition uh of a different kind it a moot point, uh, relative to the uh, uh, research universities. Uh, and, and there there’s been some suggestion uh about components in the university that don’t, uh, fall in so, you know, as we perfect the bill we may look, uh, to the university rules and codify that. But that is the reason, that is another reason to uh, exclude research universities because the University of Georgia system rules does not allow uh, individuals without lawful presence admittance, uh, at this time. And, and Representative Carpenter, I’m gonna come to you but I’m going to… I, I’m not sure this is exactly her lane but if, if um, the Attorney from the university Miss [Bowen 00:13:06], are you, you’re there? I, I don’t think this is your specific area of expertise but, did I state that correctly from conversations with the university? Miss Bowen? Bowen Chair- Chairman Martin, I have to apologize. I was um… because this isn’t my area, I was multi-tasking and looking into some matters that were just raised on [Howstel One 00:13:30]. Um, if you wouldn’t mind restating I’d be happy to, to give it a shot. Chairman Yeah, yes ma’am and, and, then t- to be honest, I know this is not your specific uh area, university. But, but the question was, you know, if, if this is a good return on investment why not allow access to research universities. And I mentioned in, in, in conversation there’s a uni- university uh policy, a rule if you will, that uh deals with admittance to, um, uh non… um, I’m gonna say this, individuals without a lawful presence. You already have a rule that doesn’t, that, that won’t allow that, uh people to be admitted to, to certain, uh, units in the university, um, because of uh, constitutional issues around public benefit. Am I correct in saying that? Bowen Yes sir, that is my understanding of it. One of our institutions has denied, um, admission to certain current Georgia residents who meet that lawful citizenship requirement. Um, then there is a benefits issue that, um, was raised by the Attorney General’s office which is a basis for a board policy. So, y- uh again, going back to- um, I’m going to go to Representative Carpenter of that but Representative Park, that, if there’s a policy discussion we want to do, but that’s the reason that’s included not because that, that is already um… th- those individuals are not by board policy admitted now. And, and then Representative Carpenter, the last part of that question for you. Carpenter Yeah and so- Well, I, I, I’ll continue on a little bit of that. So a little bit of that is, is based on the capacity of availability, right? So that ar- argument really hinges around the, is there capacity or not. The- if there’s not capacity then, then there’s, there’s not a public benefit but if there is capacity then there is a public benefit. So I think that’s where the, the terminology came through on that court case, uh, with uh, Attorney General Carr. And then as far as the uh, the, th- the exclusion on the uh, bear with me, get the line correct… exclusion on line 33, is basically a find of [crosstalk 00:15:30] just a couple of subsets of individuals. So people that are here on a student visa, with full intention of moving back to France or whatever country or India or whatever country they came, they’ve come from, just to get a education in, in Georgia. We don’t want them to allow pay for the in-state rate because one, they’re not Georgia taxpayers but two, they’re, they’res coming here to get their education and go back home. And this is, this about allowing Georgians to pay a taxpayer rate and stay in Georgia so they- ’cause that’s where they wanna be. I mean, they’re Georgia fans… uh… they’re Falcons fans, they’re, they go to church with us. I mean these are, these are people that wanna stay here. So that’s the impor- the importance of that piece, is to say look, there’s no reason for us to be giving these other individuals uh, the in-state rate. And then there’s also a, a, you know, a small subset of folks like ambassadors childrens et cetera. Chairman Thank you, uh, Representative Carpenter. And thank you uh, Representative Park. Uh… um… [Rep Clark ? 00:16:29]. Committee member Jasmine Clark (?) Uh, thank you Mr Chair. Um, uh, to my friend Mr Carpenter, thank you so much for bringing this bill. I love this bill. Um, I do just have one uh, question just to clarify. You, you mentioned it when you introduced the bill, uh, the January 1st 2013 residency requirement. That’s a very, very strindent, stringent um, residency requirement, um having maintained [inaudible 00:16:58] for eight years, as of this year. Um, a, a previous version of the bill, um, said four years. Is there any significance to this particular date? Or this particular amount of time? Carpenter Yeah, so, so that to me, th- the particular, uh the date’s really important because that’s when the, that’s when the initial, uh, run of individuals receiving DACA, that’s when it stopped. Uh, th- the, the, December 31st of 2012. That’s when the initial application process stopped. Now you’ve had subsequent application processes but most, I think those have all been renewals. So what we’re saying is, these are kids that have been in Georgia the whole time. These are kids that have gone through our K12 system, uh graduated from our high schools. Um, and so that was the importance of that piece. I think a lot of people have heartburn, uh, being a magnet for people coming from other, other states to come to Georgia, and what this bill does is it says, “Look, we’re gonna take your Georgians, uh, Georgians first.” Um… So, that, that was the point of the date. I agree it’s a long time but I think it’s important to- for folks that, you know, may have a little heartburn with this bill to understand this is, this is about taking care of the ones, the children that have been here the whole time. (silence) Chairman Don’t see any further questions. Have you anything virtually? We’re um… thank you Represent-… Chairman Representative Kausche, y- you have something further? Kausche –>No, just, thank you Mr Chairman. Just a follow up question on what Representative Clark said. If we say um, 2013, uh and would we see a need to update the bill regularly so that we keep at least the eight year requirement and not all of a sudden expand it to ten years? Eight, nine, ten, ten, nine, ten years? Chairman The, the way I heard the gentleman say is he picked that date because that was the ori- original date for the original, um, [inaudible 00:19:00] action program. So, that date itself remains static, um, we can talk about that as we uh, if the lady will allow it, we’ll talk about that as we get into the substance of the bill, um, after this, this initial hearing. But I, I think he said he picked that date, that’s a static date, that’s not gonna move, it wasn’t necessarily eigh- that it needs to be eight years from, from every year. But, that was a point in time that, that uh, um, a policy was made into federal [leveral 00:19:27] that, that created a, a group of individuals to which um, um, or to him the um, the offers trying to address the bill. Uh, Representative the Secretary of the Committee, Representative [Bentley] 00:19:39]. Rep Bentley Thank you Mr Chairman, I just basically wanted to let Representative Carpenter know I thank, thank him so much for his work on this bill, and I look forward to voting for it when it comes up for vote uh, sometime soon. And also to make sure that you knew that I was on the call, although I was on mute earlier to a roll call. Thank you. Chairman Yes ma’am we had y- we had you at the roll call. Um, okay we’ll, we’re gonna move on now to the, the hearing, uh portion of this. Um… we- we’re at uh, 11:57. Clearly we’re not gonna make it out by noon as the Chair had intended. Uh, I say that fully in, in jest. Of course we’re not. But um, i- if we could we’ll move along here. I’m gonna go, uh, down the list in the order of people signed up, um, um here. I have uh- End of bill presentation and member questions. The public testimony begins around 2:51:49 on the House livestream archive here. December 28, 2020Complaints sent to Dalton Police chief Cliff Cason – Kasey Carpenter/City of Dalton ( I have received no response) Dalton Chief of Police, Cliff Cason. Photo Dalton PD. Complaints can be read here from my media release.

October 20, 2020Continuing saga: Dalton open records: Second attempt to see GBI investigate multiple violations of state law regarding E-Verify and false documents * Kasey Carpenter Photo: USCIS News on the (Dalton) complaints on filing false documents and violation of Georgia’s E-Verify for private employer laws. Whitfield County Sheriff Scott Chitwood has declined to investigate the complaints we sent regarding the City of Dalton and restaurant owner Rep. Casey Carpenter. On the phone, I was finally successful in convincing a clearly reluctant Sheriff Chitwood to forward my complaint to the GBI, as I had originally requested but since he received the carefully laid out electronic complaints from his staff in a printed format, he told me that is how he would forward the material to GBI. I explained that the information necessary to understand my complaints could not be accessed unless the reader was using the electronic version. I am now in the process of attempting to see action from the District Attorney for Whitfield County (Bert Poston) and have sent that office the same electronic complaints with the below email with a copy sent to Diane Morgan, who I am told is the GBI Director’s assistant. I have not recieved confirmation of receipt and am now calling both offices:

October 19, 2020Response from Whitfield County Sheriff Scott Chitwood on complaints for violation of state law Re: Dalton open records *Kasey CarpenterThe below email from Sheriff Chitwood was received here on October 14, 2020 at 9:30 AM. It was actually two complaints. Both here. We also spoke on the telephone when I called him before I saw his email to me.  Sheriff Scott Chitwood. Photo, WCSD

“Your complaint was received, but after reading over it, the Whitfield Co. Sheriffs’ Office would not oversee such a complaint. Your attention should be directed to the City of Dalton.” _______ Update: 17 Nov 2020: I sent the complaints to the Whitfield County area District Attorney the same day I received the above answer from the Whitfield County Sheriff. But, we think it important to note the guidelines provided by the Georgia Bureau of Investigation on how they get involved in an investigation. From the GBI website, FAQ page: Frequently Asked Questions

October 5, 2020Open records request – additional response from City of Dalton RE: Missing year’s affidavit from Oakwood Cafe *Kasey Carpenter

Photo: City of Dalton The response on top was received here Oct 2, 5:23PM. We are grateful for the follow-up. _ Mr. King, I am sending a second follow up message to reply to the concerns you relayed; specifically, you noted that copies of the 2013 and 2014 Occupational Tax Certificate applications/affidavits for Oakwood Café were not present in the responsive document which we relayed to you. I checked with the City Clerk’s office and was reminded that the retention schedule for SAVE and E-Verify affidavits is three (3) years according to the guidelines provided by the Secretary of State for Georgia (see details below. Thus, the City is simply not in possession of those physical records you requested for the years 2013 and 2014 (applications/affidavits). If you review the Excel spreadsheet documents which the City provided you, however, you will see that Oakwood’s records for those years are listed as being submitted to the Georgia state audit system in compliance with the law. I regret that we did not let you know in advance that we did not possess those physical records as indicated above, but the City’s response to your records request provided all of the responsive records in our possession at the time of your request. LG-16-038 | SAVE and E-Verify Affidavits Thank you for the opportunity to respond to your follow up questions, and feel free to contact me directly by email or phone if I can assist you further. Best Regards, PLEASE NOTE – MY EMAIL DOMAIN HAS CHANGED – UPDATE CONTACT TO EMAIL ADDRESS BELOW jparker@daltonga.gov Jason Parker From: Jason Parker Good Afternoon, I apologize for the delay in response and thanks for your follow-up questions as we strive to respond accurately and timely to all requests for public records. I am checking to see if there was an oversight in the records search and will get back with you shortly. Feel free to call or email if you have questions in the meantime. PLEASE NOTE – MY EMAIL DOMAIN HAS CHANGED – UPDATE CONTACT TO EMAIL ADDRESS BELOW jparker@daltonga.gov Jason Parker September 29, 2020City of Dalton Occupational Tax Certificate (Business License) – Complaint (#2) filed against Rep Kasey Carpenter, owner of Oakwood Cafe and Cherokee Brewing and Pizza Photo: USCIS  Photo: WCSO.

The below complaint was sent to the Whitfield County Sheriff office this AM. I have recieved confirmation of receipt.

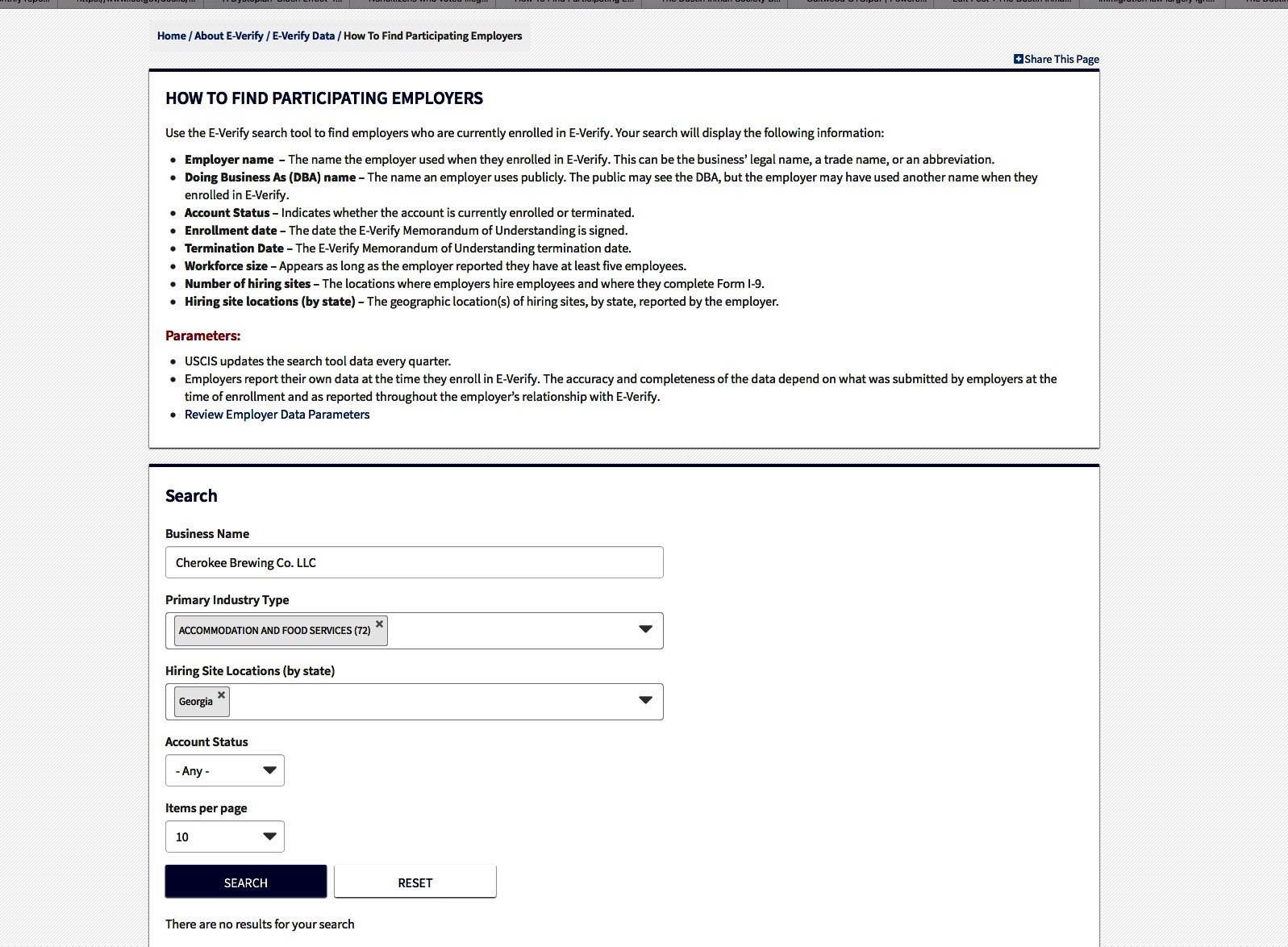

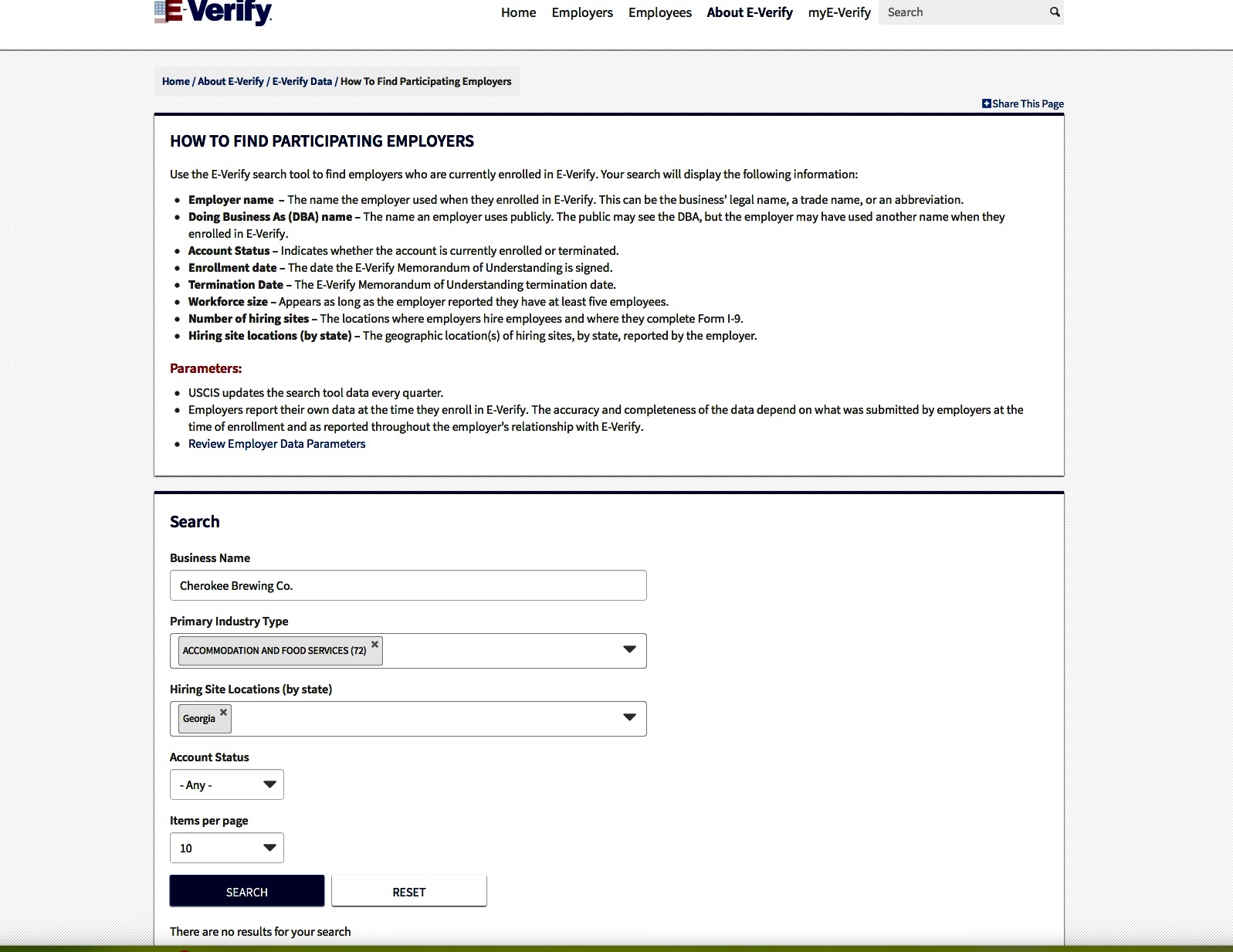

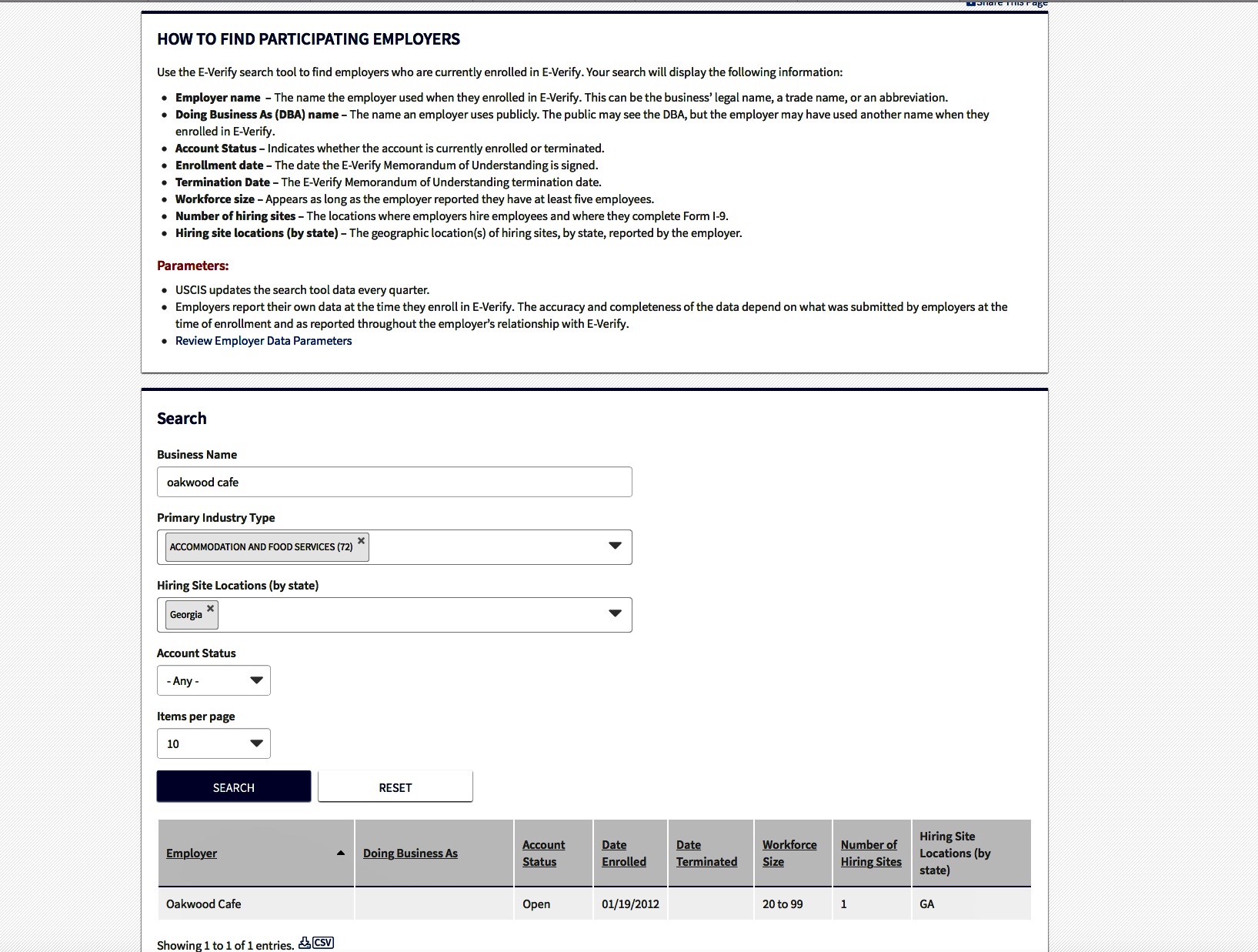

Complaint #2 of 2. Complaint #1 here. Re: Possible violations OCGA 36-60-6 & OCGA 16-10-20 To: Scott Chitwood Sheriff, Whitfield County Georgia *Please note that throughout this complaint I have inserted hyperlinks to evidence and facts that make the issue much easier to understand and to save time for investigators. Sheriff Chitwood, Please regard this as an official complaint against Dalton business owner State Rep Kasey Carpenter alleging possible violations of OCGA 36-60-1 (E-Verify requirement for private employers) and OCGA 16-10-20 (Filing false documents) and a request for an investigation by the GBI. In my own educated but obviously unofficial investigation of the workings of the City of Dalton’s Occupational Tax Certificate (OTC) office (please see complaint #1), I obtained various documents through open records requests on two Dalton businesses, Oakwood Café and Cherokee Brewing and Pizza (Cherokee Brewing LLC). The purpose of accessing these documents was to understand the system in place for administering public benefits, specifically OTCs and to compare the operation and documents used to clear mandates in state law. As can be seen in my other recent complaint (#1 of 2), I found multiple actions that I believe are illegal and require official investigation and possible prosecution. In reviewing the copies of OTC applications and affidavits, I noted that on the November 2014 application for the City of Dalton to issue an OTC for the year 2015, owner Kasey Carpenter completed a notarized affidavit attesting to use of the federal E-Verify program, entered the unique user/ID number issued to his business by USCIS and entered “11-11-’14 as the date of authorization to use E-Verify. The service provided by USCIS to track E-Verify users (“How to Find Participating Employers”) shows that Oakwood Cafe was authorized to use E-Verify on 1/19/12. Clearly stated, the dates do not match on a very important document that serves as evidence of eligibility for Oakwood Café to be issued an Occupational Tax Certificate which is required to do business lawfully in Dalton, GA. My open records request included a time frame of 1 July 2012 to 15 September 2020. It did not produce any copies of any documents from the Dalton OTC office for Oakwood Cafe completed in 2013 for the OTC to be issued for 2014. I am informed that Oakwood Café has been in business since 2004. As I noted on complaint #1, this seems to indicate that although it was apparently diong (doing) business, Oakwood Café was not issued an OTC for 2014. There may be an easy answer to this confusion of which I am not aware. —> Cherokee Brewing and Pizza – (Cherokee Brewing LLC) Much more concerning is the fact that in reviewing the copies of documents sent by the Dalton OTC office, Kasey Carpenter, an owner of Cherokee Brewing and Pizza signed an affidavit attesting to use of the E-Verify, entered the date of authorization to use the system as “9/15/’19” and did not enter the required user/ID number of the E-Verify system which is assigned by the USCIS. Apparently the OTC office in Dalton accepted this illegal affidavit (see complaint #1) without it being notarized. The USCIS tracking database for E-Verify users (How to Find Participating Employers) does not produce records of any authorization for Cherokee Brewing and Pizza or Cherokee Brewing Co. or Cherokee Brewing LLC to use E-Verify. –> Stated more clearly, in applying to obtain an OTC, owner and applicant for the OTC, Rep Kasey Carpenter says Cherokee Brewing has been authorized to use E-Verify since Sept 15, 2019. The United States Citizenship and Immigration Services says they have no record of that authorization. It should be noted that according to the state law on private employers use of E-verify for employers with more than ten employees. Cherokee Brewing has completed documents for a Dalton OTC reporting more than ten employees since 2018. OCGA 36-6-6:

The copies of all documents sent to me by the City of Dalton for Cherokee Brewing and Pizza can be seen here. For Oakwood Café, here. I want to be clear that I hope I am mistaken in wondering if a state legislator and Dalton business owner has misrepresented his use of E-Verify or violated state law to obtain the OTC required to operate business lawfully. OCGA 36-60-6(h) Any person presenting false or misleading evidence of state licensure shall be guilty of a misdemeanor. Any government official or employee knowingly acting in violation of this Code section shall be guilty of a misdemeanor; provided, however, that any person who knowingly submits a false or misleading affidavit pursuant to this Code section shall be guilty of submitting a false document in violation of Code Section 16-10-20 (j) The Attorney General shall be authorized to conduct an investigation and bring any criminal or civil action he or she deems necessary to ensure compliance with the provisions of this Code section…. During the course of any investigation of violations of this Code section, the Attorney General shall also investigate potential violations of Code Section 16-9-121.1 by employees that may have led to violations of this Code section. —>Filing false documents is a serious violation under OCGA 16-10-20, which I respectfully paste below to eliminate confusion: § 16-10-20.1. Filing false documents (a) As used in this Code section, the term “document” means information that is inscribed on a tangible medium or that is stored in an electronic or other medium and is retrievable in perceivable form and shall include, but shall not be limited to, liens, encumbrances, documents of title, instruments relating to a security interest in or title to real or personal property, or other records, statements, or representations of fact, law, right, or opinion. (b) Notwithstanding Code Sections 16-10-20 and 16-10-71, it shall be unlawful for any person to: (1) Knowingly file, enter, or record any document in a public record or court of this state or of the United States knowing or having reason to know that such document is false or contains a materially false, fictitious, or fraudulent statement or representation; or (2) Knowingly alter, conceal, cover up, or create a document and file, enter, or record it in a public record or court of this state or of the United States knowing or having reason to know that such document has been altered or contains a materially false, fictitious, or fraudulent statement or representation. (c) Any person who violates subsection (b) of this Code section shall be guilty of a felony and, upon conviction thereof, shall be punished by imprisonment of not less than one nor more than ten years, a fine not to exceed $10,000.00, or both. (d) This Code section shall not apply to a court clerk, registrar of deeds, or any other government employee who is acting in the course of his or her official duties. I ask that you forward my complaint to Director Vic Reynolds and the Georgia Bureau of Investigation. Sheriff Chitwood, on a personal note, as a 68 year-old former Marine, grandson of a police officer (Detroit Police Academy, class of 1928) and someone who has devoted the last seventeen years of his life to actively advocating for immigration enforcement, please accept my sincere gratitude for the courageous job you and your deputies and staff do for Whitfield County and Georgia. At our house we respect and support law enforcement officers and pray for your safety. Also, I have been an advocate for 287(g) since 2004 and am proud to have assisted in implementing the lifesaving 287(g) program in Gwinnett County. Please know the high level of admiration we have for you for your participation in that commonsense program. I apologize for the length of this complaint. Please know that I have spent many hours on research and in compiling the information gathered. I was closely involved in the creation of the laws cited here and have great interest in seeing them actually enforced. Respectfully submitted, D.A. King Marietta, GA. 30066

City of Dalton Occupational Tax Certificate (Business License) Complaint (#1) Against City Officials * Kasey Carpenter Photo: USCIS

The below complaint was sent to Whitfield Couny Sheriff Chitwood this AM. I have received confirmation of receipt  Photo: WCSO.

___ Complaint #1 of 2 (complaint # 2 here). Re: Multiple violations OCGA 36-60-6 & OCGA 50-36-1 To: Scott Chitwood Sheriff, Whitfield County Georgia *Please note that throughout this complaint I have inserted hyperlinks to evidence and facts that make the issue much easier to understand and to save time for investigators. Sheriff Chitwood, Please regard this as an official complaint against the following City of Dalton officials for repeated and ongoing violations of OCGA 36-60-1 (E-Verify requirement for private employers) and OCGA 50-36-1 (verification of lawful status for public benefits). Mayor David Pennington Councilmember Derek Waugh Councilmember Annalee Harlan Councilmember Tyree Goodlet Councilmember Gary Crews City Clerk Bernadette Chattam I ask that you forward my complaint to Director Vic Reynolds and the Georgia Bureau of Investigation. The E-Verify law As part of HB 87, in 2011 (and 2013) language that is now OCGA 36-60-6 (posted here) went through a long and arduous committee process, was passed by the General Assembly and signed into law by then Governor Nathan Deal. The intent of the law is to reduce illegal immigration in Georgia, protect lawful workers by reducing illegal employment and the black market labor that reportedly costs Georgia taxpayers billions of dollars annually. The additional concept was, and is, that the fewer illegal aliens we host in Georgia, fewer lawful residents would be affected by crimes committed by illegal aliens. Those crimes include identity theft and fraud. Illegal aliens cannot obtain employment without committing identity crimes, which all too often can ruin the lives of innocent victims. The law is clear that private employers with more than ten employees are required to use the federal E-Verify system: “(a) Every private employer with more than ten employees shall register with and utilize the federal work authorization program, as defined by Code Section 13-10-90. The requirements of this subsection shall be effective on January 1, 2012, as to employers with 500 or more employees, on July 1, 2012, as to employers with 100 or more employees but fewer than 500 employees, and on July 1, 2013, as to employers with more than ten employees but fewer than 100 employees.” The law also requires agencies that administer/issue/renew Occupational Tax Certificates (OTC) to collect information on affidavits from the employer that shows the number of employees he has, his unique E-Verify user/ID number issued by the United States Citizenship and Immigration Services or a statement that he is exempt from the E-Verify requirement because he has fewer than eleven employees. Also required is the date the employer was authorized to use E-Verify. “(d)(1)Before any county or municipal corporation issues a business license, occupational tax certificate, or other document required to operate a business to any person, the person shall provide evidence that he or she is authorized to use the federal work authorization program or evidence that the provisions of this Code section do not apply. Evidence of such use shall be in the form of an affidavit as provided by the Attorney General in subsection (f) of this Code section attesting that he or she utilizes the federal work authorization program in accordance with federal regulations or that he or she employs fewer than 11 employees or otherwise does not fall within the requirements of this Code section. Whether an employer is exempt from using the federal work authorization program as required by this Code section shall be determined by the number of employees employed by such employer on January 1 of the year during which the affidavit is submitted. The affidavit shall include the employer’s federally assigned employment eligibility verification system user number and the date of authority for use…” (2) Upon satisfying the requirements of paragraph (1) of this subsection, for all subsequent renewals of a business license, occupation tax certificate, or other document, the person shall submit to the county or municipality his or her federal work authorization user number or assert that he or she is exempt from this requirement, provided that the federal work authorization user number provided for the renewal is the same federal work authorization user number as provided in the affidavit under paragraph (1) of this subsection. If the federal work authorization user number is different than the federal work authorization user number provided in the affidavit under paragraph (1) of this subsection, then the person shall be subject to the requirements of subsection (g) of this Code section. The drafters of the law foresaw the likelihood of different agencies inventing their own style and format of forms and affidavits and sought to eliminate confusion and baseless violation defense of “we didn’t know…we have our own way of doing things…” by requiring the Attorney General to create a standardized form which the law says “…shall be used…” (f) In order to assist private businesses and counties and municipal corporations in complying with the provisions of this Code section, the Attorney General shall provide a standardized form affidavit which shall be used as acceptable evidence demonstrating use of the federal employment eligibility verification system or that the provisions of subsection (b) of this Code section do not apply to the applicant. The form affidavit shall be posted by the Attorney General on the Department of Law’s official website no later than January 1, 2012. I have posted that form here. Please note the area on the bottom for notarization. OCGA 50-36-1 This law was put in place in 2006 in an attempt to make Georgia less attractive to illegal aliens by insuring that only eligible residents were allowed to access public benefits (which include Occupational Tax Certificates). The Dept. of Audits and Accounts is charged under the law to create an affidavit that applicants for public benefits complete attesting to eligibility for these public benefits. This document is known as “Verification of Lawful Presence in the United States” affidavit. (50-36-1: (2) “The state auditor shall create affidavits for use under this subsection and shall keep a current version of such affidavits on the Department of Audits and Accounts’ official website.” That affidavit can be seen here from the Dept. of Audits and Accounts In clear violation of state law, the City of Dalton leaders have invented and is using their own unauthorized version of this document. I suspect that city leaders are using their own illegal verification of lawful presence affidavit for other public benefits applications as well. I will assume that your office or the GBI will investigate that subject further. Complaint * The City of Dalton office that issues Occupational Tax Certificates is in violation of OCGA 50-36-1 by use of an illegal affidavit. * After spending a great deal of my own time on investigating the system used by the City of Dalton office that issues Occupational Tax Certificates, I see several ongoing violations. They include (but are not limited to) the fact that Dalton has ignored the law and invented it’s own jumbled affidavit to illegally replace the Private Employer Affidavit pursuant to OCGA 36-60-6 (d) that is readily available for use on the website of the Attorney General. In addition to designing an unauthorized affidavit, the Dalton OTC office has curiously added the word “EXEMPT” in caps, bold and underlined above an unrelated section of their illegal official document that makes no sense. This addition should be explained. I was able to see the Dalton OTC office’s issuing operation by using the state’s open records law and asking for copies of required documents required for issue and renewal for the time period 1 July 2012 to 15 September 2020 for two Dalton businesses (Oakwood Cafe and Cherokee Brewing and Pizza) chosen at random. While the response to my request was timely, the documents that logically should have been included for the 2013 application for the 2014 issuance of the OTC for Oakwood Cafe were not included. Response to open records request Oakwood Café here. For Cherokee Brewing and Pizza here. I wrote a note to the staffer who helped me to ask if the omission of the 2013/2014 documents an oversight, but I received no reply. * It appears that the Dalton OTC office did not process an application or issue a 2014 OTC for Oakwood Cafe. Previous and subsequent years documents were sent to me for that business. Reliable press reports indicate that Oakwood Café has been open since 2004. I understand how dry and uninteresting this topic is to the general public. But the law serves an integral purpose to fighting the organized crime of illegal immigration, which is largely caused by illegal employment. I have no doubt my documented complaint will be treated to be as important as our other laws including tax-evasion, no-smoking, seat belt and laws that say we must provide certain benefits to illegal aliens. As for standardized forms, imagine if we all begin to send in our annual taxes filled out on homemade forms of our own design. Summary: The City of Dalton OTC office (and likely other Dalton offices that administer public benefits) is in violation of OCGA 50-36-1 in that it is using an illegal affidavit to replace one that was carefully and officially designed to screen applicants for public benefits and to reduce the chances of those taxpayer benefits going to illegal aliens. The City of Dalton Occupational Tax Certificate office is in violation of OCGA 36-60-6 in several ways – and in at least two languages. These violations are not limited to the fact that city officials are ignoring the law on proper and designated forms distributed to collect information used to monitor compliance with the E-Verify for private employers requirement. I do not have an explanation for the fact that they cannot present applications, affidavits or certificates for Oakwood Cafe for the year 2014. I hope an official investigation will offer an explanation to all of this. I would be grateful if you inform me of any oversight here on my part. I contend that the City of Dalton has illegally processed hundreds if not thousands of illegal applications/affidavits and thereby has issued as many illegal and invalid Occupational Tax Certificates and illegally administered an unknown number of public benefits to an unknown number of recipients. I link to a list of public benefits regulated by OCGA 50-36-1 here. I question the legality and validity of all Occupational Tax Certificates now being regarded as lawfully issued and recognized by the City of Dalton. I ask that your office forward this complaint to the GBI and that the Attorney General prosecute the violators so as to serve as a deterrent to other officials who are not compelled to have an interest in strict compliance with the E-Verify laws in Georgia. OCGA 36-60-6: (h) Any person presenting false or misleading evidence of state licensure shall be guilty of a misdemeanor. Any government official or employee knowingly acting in violation of this Code section shall be guilty of a misdemeanor; provided, however, that any person who knowingly submits a false or misleading affidavit pursuant to this Code section shall be guilty of submitting a false document in violation of Code Section 16-10-20. It shall be a defense to a violation of this Code section that such person acted in good faith and made a reasonable attempt to comply with the requirements of this Code section. (j) The Attorney General shall be authorized to conduct an investigation and bring any criminal or civil action he or she deems necessary to ensure compliance with the provisions of this Code section. The Attorney General shall provide an employer who is found to have committed a good faith violation of this Code section 30 days to demonstrate to the Attorney General that such employer has come into compliance with this Code section. During the course of any investigation of violations of this Code section, the Attorney General shall also investigate potential violations of Code Section 16-9-121.1 by employees that may have led to violations of this Code section. Sheriff Chitwood, on a personal note, as a 68 year-old former Marine, grandson of a police officer (Detroit Police Academy, class of 1928) and someone who has devoted the last seventeen years of his life to actively advocating for immigration enforcement, please accept my sincere gratitude for the courageous job you and your deputies and staff do for Whitfield County and Georgia. At our house we respect and support law enforcement officers and pray for your safety. Also, I have been an advocate for 287(g) since 2004 and am proud to have assisted in implementing the lifesaving 287(g) program in Gwinnett County. Please know the high level of admiration we have for you for your participation in that commonsense program. I apologize for the length of this complaint. Please know that I have spent many hours on research and in compiling the information gathered. I was closely involved in the creation of the laws cited here and have great interest in seeing them actually enforced. Respectfully submitted, D.A. King President, the Dustin Inman Society Marietta, GA. 30066

September 24, 2020Open records City of Dalton – Cherokee Brewing Co. & LLC version – – USCIS says no E-Verify * Kasey Carpenter Photo: City of Dalton  Image: USCIS

Image: USCIS Open records request City of Dalton Re: Oakwood Cafe – USCIS says E-verify authority began 2012 * Kasey Carpenter Photo: City of Dalton

Image USCIS

|