How to create a new revenue source to raise pay of Georgia’s local law enforcement officers – tax filers pay zero: The Remittance Fee in Oklahoma, Georgia, and in the U.S. Congress

David North – CIS

The Remittance Fee in Oklahoma, Georgia, and in the U.S. Congress

January 3, 2018

It’s time to take a new look at a nearly totally ignored potential source of governmental revenue — taken mostly from illegal aliens and drug dealers — to see how three different jurisdictions are handling the issue. Potentially it could bring in well over $2 billion a year for the federal and/or state governments, and not one penny would be paid by law-abiding residents.

Sounds like a winner, right? But Chamber of Commerce types have fought it successfully, except in Oklahoma, where there is such an arrangement.

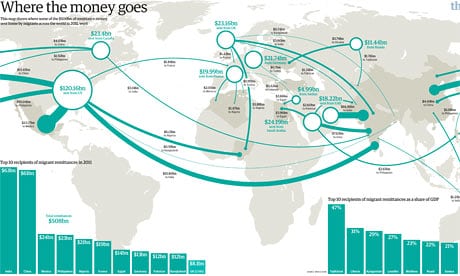

What I have in mind is a 2 percent withholding fee on wire transfers out of the nation, i.e., on cash transfers that would include illegal aliens’ remittances to their homelands, some drug trades, and some legitimate, non-corporate money transactions. There would be no charge on corporate transfers. Note that we are proposing a fee, not a tax. The concept is that it is a withholding, a credit against one’s income tax, and thus costs nothing to law-abiding, tax-paying people.

In fact, Oklahoma tax authorities tell us, most of the fees are not reported on state income tax filings, and thus the moneys collected are a de facto tax on otherwise untaxed income. Chamber of Commerce objections relate not only to a knee-jerk reaction to new taxes of any kind, but also to the rational (if objectionable) fear that taxing the income of illegals in any way will push up pressure on the wages paid to those workers, and thus would reduce the profits of businessmen using illegal alien workers. (That is the presumed C of C rationale, not its public position.)

So, how is this issue playing out in Oklahoma, in Georgia, and with the federal government?

Oklahoma. This is the only state in the nation with a wire-transfer fee, as we have reported earlier, and the state’s most recent annual tax report (for fiscal year 2016-2017) showed that the wire transfer fee brought in $12,873,864. Oklahoma has a 1 percent fee.

While both business interests and the Government of Mexico (in an open manner, unlike Russian interventions in our politics) objected to the bill, it was adopted by the state legislature, and is no longer the subject of controversy. The annual collections increase each year by about 10 percent. It stands as a model for the rest of the nation.

Georgia. There is before this state’s legislature, as there may be elsewhere (but unknown to us), a bill (HR 66) to replicate the Oklahoma system at the 2 percent level. It was introduced by a member of the Republican majority in the State House of Representatives, State Rep. Jeff Jones (Brunswick)… read the rest here.