Photo: USCIS

The below complaint was sent to Whitfield Couny Sheriff Chitwood this AM. I have received confirmation of receipt

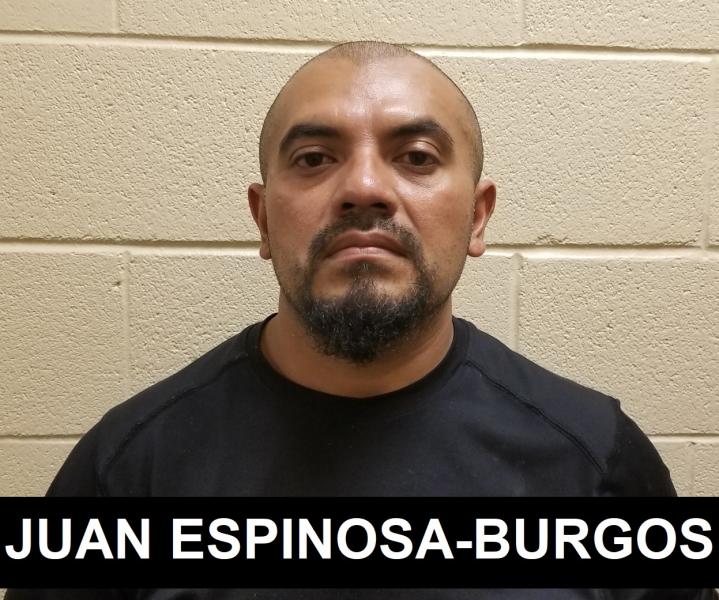

Photo: WCSO.

___

Complaint #1 of 2 (complaint # 2 here).

Re: Multiple violations

OCGA 36-60-6 & OCGA 50-36-1

To: Scott Chitwood

Sheriff, Whitfield County Georgia

*Please note that throughout this complaint I have inserted hyperlinks to evidence and facts that make the issue much easier to understand and to save time for investigators.

Sheriff Chitwood,

Please regard this as an official complaint against the following City of Dalton officials for repeated and ongoing violations of OCGA 36-60-1 (E-Verify requirement for private employers) and OCGA 50-36-1 (verification of lawful status for public benefits).

Mayor David Pennington

Councilmember Derek Waugh

Councilmember Annalee Harlan

Councilmember Tyree Goodlet

Councilmember Gary Crews

City Clerk Bernadette Chattam

I ask that you forward my complaint to Director Vic Reynolds and the Georgia Bureau of Investigation.

The E-Verify law

As part of HB 87, in 2011 (and 2013) language that is now OCGA 36-60-6 (posted here) went through a long and arduous committee process, was passed by the General Assembly and signed into law by then Governor Nathan Deal. The intent of the law is to reduce illegal immigration in Georgia, protect lawful workers by reducing illegal employment and the black market labor that reportedly costs Georgia taxpayers billions of dollars annually.

The additional concept was, and is, that the fewer illegal aliens we host in Georgia, fewer lawful residents would be affected by crimes committed by illegal aliens.

Those crimes include identity theft and fraud. Illegal aliens cannot obtain employment without committing identity crimes, which all too often can ruin the lives of innocent victims.

The law is clear that private employers with more than ten employees are required to use the federal E-Verify system:

“(a) Every private employer with more than ten employees shall register with and utilize the federal work authorization program, as defined by Code Section 13-10-90. The requirements of this subsection shall be effective on January 1, 2012, as to employers with 500 or more employees, on July 1, 2012, as to employers with 100 or more employees but fewer than 500 employees, and on July 1, 2013, as to employers with more than ten employees but fewer than 100 employees.”

The law also requires agencies that administer/issue/renew Occupational Tax Certificates (OTC) to collect information on affidavits from the employer that shows the number of employees he has, his unique E-Verify user/ID number issued by the United States Citizenship and Immigration Services or a statement that he is exempt from the E-Verify requirement because he has fewer than eleven employees. Also required is the date the employer was authorized to use E-Verify.

“(d)(1)Before any county or municipal corporation issues a business license, occupational tax certificate, or other document required to operate a business to any person, the person shall provide evidence that he or she is authorized to use the federal work authorization program or evidence that the provisions of this Code section do not apply. Evidence of such use shall be in the form of an affidavit as provided by the Attorney General in subsection (f) of this Code section attesting that he or she utilizes the federal work authorization program in accordance with federal regulations or that he or she employs fewer than 11 employees or otherwise does not fall within the requirements of this Code section. Whether an employer is exempt from using the federal work authorization program as required by this Code section shall be determined by the number of employees employed by such employer on January 1 of the year during which the affidavit is submitted. The affidavit shall include the employer’s federally assigned employment eligibility verification system user number and the date of authority for use…”

(2) Upon satisfying the requirements of paragraph (1) of this subsection, for all subsequent renewals of a business license, occupation tax certificate, or other document, the person shall submit to the county or municipality his or her federal work authorization user number or assert that he or she is exempt from this requirement, provided that the federal work authorization user number provided for the renewal is the same federal work authorization user number as provided in the affidavit under paragraph (1) of this subsection. If the federal work authorization user number is different than the federal work authorization user number provided in the affidavit under paragraph (1) of this subsection, then the person shall be subject to the requirements of subsection (g) of this Code section.

The drafters of the law foresaw the likelihood of different agencies inventing their own style and format of forms and affidavits and sought to eliminate confusion and baseless violation defense of “we didn’t know…we have our own way of doing things…” by requiring the Attorney General to create a standardized form which the law says “…shall be used…”

(f) In order to assist private businesses and counties and municipal corporations in complying with the provisions of this Code section, the Attorney General shall provide a standardized form affidavit which shall be used as acceptable evidence demonstrating use of the federal employment eligibility verification system or that the provisions of subsection (b) of this Code section do not apply to the applicant. The form affidavit shall be posted by the Attorney General on the Department of Law’s official website no later than January 1, 2012.

I have posted that form here. Please note the area on the bottom for notarization.

OCGA 50-36-1

This law was put in place in 2006 in an attempt to make Georgia less attractive to illegal aliens by insuring that only eligible residents were allowed to access public benefits (which include Occupational Tax Certificates). The Dept. of Audits and Accounts is charged under the law to create an affidavit that applicants for public benefits complete attesting to eligibility for these public benefits. This document is known as “Verification of Lawful Presence in the United States” affidavit.

(50-36-1: (2) “The state auditor shall create affidavits for use under this subsection and shall keep a current version of such affidavits on the Department of Audits and Accounts’ official website.”

That affidavit can be seen here from the Dept. of Audits and Accounts

In clear violation of state law, the City of Dalton leaders have invented and is using their own unauthorized version of this document. I suspect that city leaders are using their own illegal verification of lawful presence affidavit for other public benefits applications as well. I will assume that your office or the GBI will investigate that subject further.

Complaint

* The City of Dalton office that issues Occupational Tax Certificates is in violation of OCGA 50-36-1 by use of an illegal affidavit.

* After spending a great deal of my own time on investigating the system used by the City of Dalton office that issues Occupational Tax Certificates, I see several ongoing violations. They include (but are not limited to) the fact that Dalton has ignored the law and invented it’s own jumbled affidavit to illegally replace the Private Employer Affidavit pursuant to OCGA 36-60-6 (d) that is readily available for use on the website of the Attorney General.

In addition to designing an unauthorized affidavit, the Dalton OTC office has curiously added the word “EXEMPT” in caps, bold and underlined above an unrelated section of their illegal official document that makes no sense. This addition should be explained.

I was able to see the Dalton OTC office’s issuing operation by using the state’s open records law and asking for copies of required documents required for issue and renewal for the time period 1 July 2012 to 15 September 2020 for two Dalton businesses (Oakwood Cafe and Cherokee Brewing and Pizza) chosen at random. While the response to my request was timely, the documents that logically should have been included for the 2013 application for the 2014 issuance of the OTC for Oakwood Cafe were not included.

Response to open records request Oakwood Café here. For Cherokee Brewing and Pizza here.

I wrote a note to the staffer who helped me to ask if the omission of the 2013/2014 documents an oversight, but I received no reply.

* It appears that the Dalton OTC office did not process an application or issue a 2014 OTC for Oakwood Cafe. Previous and subsequent years documents were sent to me for that business. Reliable press reports indicate that Oakwood Café has been open since 2004.

I understand how dry and uninteresting this topic is to the general public. But the law serves an integral purpose to fighting the organized crime of illegal immigration, which is largely caused by illegal employment.

I have no doubt my documented complaint will be treated to be as important as our other laws including tax-evasion, no-smoking, seat belt and laws that say we must provide certain benefits to illegal aliens. As for standardized forms, imagine if we all begin to send in our annual taxes filled out on homemade forms of our own design.

Summary:

The City of Dalton OTC office (and likely other Dalton offices that administer public benefits) is in violation of OCGA 50-36-1 in that it is using an illegal affidavit to replace one that was carefully and officially designed to screen applicants for public benefits and to reduce the chances of those taxpayer benefits going to illegal aliens.

The City of Dalton Occupational Tax Certificate office is in violation of OCGA 36-60-6 in several ways – and in at least two languages. These violations are not limited to the fact that city officials are ignoring the law on proper and designated forms distributed to collect information used to monitor compliance with the E-Verify for private employers requirement.

I do not have an explanation for the fact that they cannot present applications, affidavits or certificates for Oakwood Cafe for the year 2014. I hope an official investigation will offer an explanation to all of this. I would be grateful if you inform me of any oversight here on my part.

I contend that the City of Dalton has illegally processed hundreds if not thousands of illegal applications/affidavits and thereby has issued as many illegal and invalid Occupational Tax Certificates and illegally administered an unknown number of public benefits to an unknown number of recipients.

I link to a list of public benefits regulated by OCGA 50-36-1 here.

I question the legality and validity of all Occupational Tax Certificates now being regarded as lawfully issued and recognized by the City of Dalton.

I ask that your office forward this complaint to the GBI and that the Attorney General prosecute the violators so as to serve as a deterrent to other officials who are not compelled to have an interest in strict compliance with the E-Verify laws in Georgia.

OCGA 36-60-6:

(h) Any person presenting false or misleading evidence of state licensure shall be guilty of a misdemeanor. Any government official or employee knowingly acting in violation of this Code section shall be guilty of a misdemeanor; provided, however, that any person who knowingly submits a false or misleading affidavit pursuant to this Code section shall be guilty of submitting a false document in violation of Code Section 16-10-20. It shall be a defense to a violation of this Code section that such person acted in good faith and made a reasonable attempt to comply with the requirements of this Code section.

(j) The Attorney General shall be authorized to conduct an investigation and bring any criminal or civil action he or she deems necessary to ensure compliance with the provisions of this Code section. The Attorney General shall provide an employer who is found to have committed a good faith violation of this Code section 30 days to demonstrate to the Attorney General that such employer has come into compliance with this Code section. During the course of any investigation of violations of this Code section, the Attorney General shall also investigate potential violations of Code Section 16-9-121.1 by employees that may have led to violations of this Code section.

Sheriff Chitwood, on a personal note, as a 68 year-old former Marine, grandson of a police officer (Detroit Police Academy, class of 1928) and someone who has devoted the last seventeen years of his life to actively advocating for immigration enforcement, please accept my sincere gratitude for the courageous job you and your deputies and staff do for Whitfield County and Georgia.

At our house we respect and support law enforcement officers and pray for your safety.

Also, I have been an advocate for 287(g) since 2004 and am proud to have assisted in implementing the lifesaving 287(g) program in Gwinnett County. Please know the high level of admiration we have for you for your participation in that commonsense program.

I apologize for the length of this complaint. Please know that I have spent many hours on research and in compiling the information gathered. I was closely involved in the creation of the laws cited here and have great interest in seeing them actually enforced.

Respectfully submitted,

D.A. King

President, the Dustin Inman Society

Marietta, GA. 30066